Ammonia: Zero carbon marine fuel?

Ammonia is a key intermediate for fertilizers such as urea, ammonium nitrate, ammonium phosphate and NPK compounds as well as a variety of industrial applications such as synthetic resins (urea-based), synthetic fibres (acrylics and nylons), polyurethanes, explosives (ammonium nitrate-based) and refrigeration. Ammonia is also currently being considered as an alternative to fossil fuels for power generation and shipping.

NexantECA - End-Use of Ammonia and Its Derivatives

Green ammonia has the potential to decarbonise transportation where large amounts of energy are required for long periods of time. The complete combustion of the green ammonia produces no greenhouse gases, just nitrogen and water, potentially displacing the carbon dioxide emissions currently released by the combustion of traditional fossil fuels.

A key end-use identified for ammonia fuel, is industrial shipping, which contributes between 2-3 percent of global CO2 emissions and is one of the few sectors left out of the language of the Paris Agreement on climate change. Shipping plays a major role in the world economy, carrying more than 80 percent of the worlds global trade by volume but at present has made few inroads toward decarbonisation and is forecast to account for over 15 percent of global emissions by 2050 if no progress is made.

In 2018, the International Maritime Organisation (IMO) released their initial strategy to reduce greenhouse gas (GHG) emissions from industrial shipping with a target of reduction in carbon intensity (CO2 per tonne-mile) by at least 40 percent by 2030 compared to a 2008 baseline. By 2050 the IMO targets a reduction in total GHG emissions by 50 percent (compared to 2008) and reduction in carbon intensity by 70 percent. It is expected that the IMO 2030 target can be met with tighter design specifications for newbuild vessels, increased operational efficiency, slow steaming, and the use of liquified natural gas (LNG) as a bunkering fuel. Despite zero carbon fuel not being required to meet the IMO 2030 target it is expected that marine shipping companies will start investing on a voluntary level to ensure they have zero carbon fuels available to meet the more aggressive IMO 2050 targets. Several bulk freight companies are following the same trend indicated that they intend to skip the purchase of LNG vessels and focus on low/zero carbon fuels.

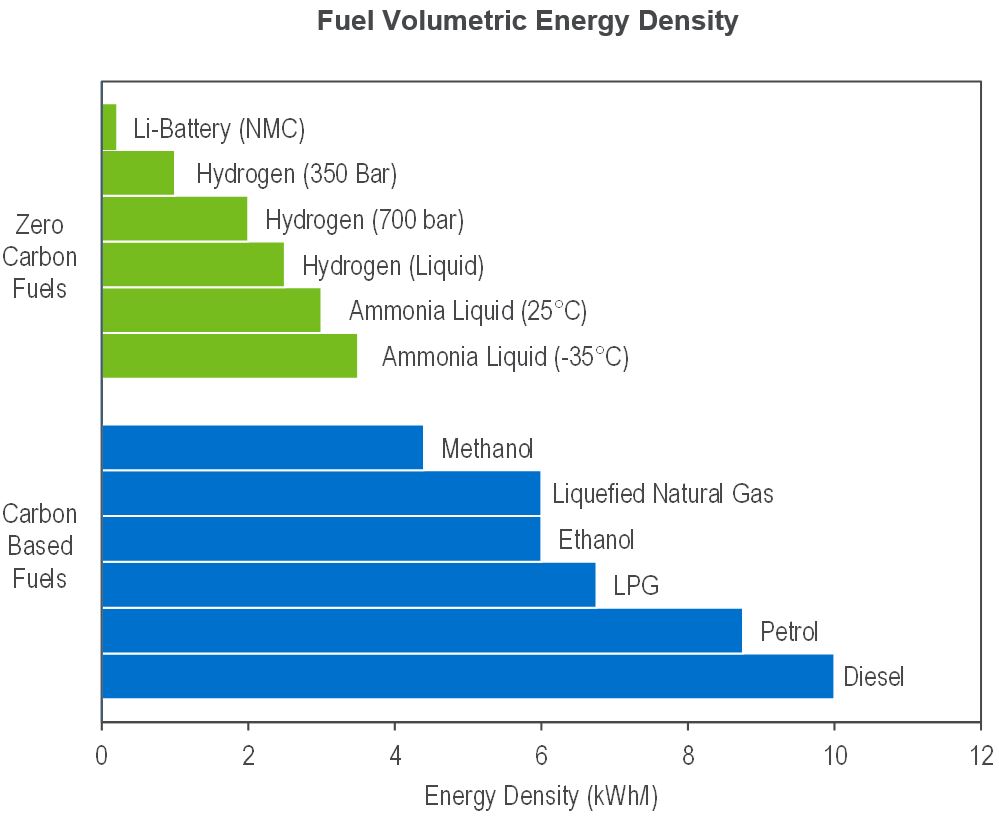

Ammonia has a lower energy density than conventional marine fuels but is significantly higher than the other zero carbon alternatives including hydrogen and lithium batteries (displayed in the figure below). Given the long distances, electrifying ship propulsion units is not seen as a viable alternative, due to the associated battery requirements leading to excessive weight. For hydrogen to have a comparable volumetric energy density (75 percent) to liquid ammonia it would need to be stored on board as a cryogenic liquid at -253 ºC which would be significantly more expensive and energy intensive than cost of storing liquid ammonia at -33 ºC. Furthermore, unlike cryogenic hydrogen, liquid ammonia is an established large scale commodity product, ammonia infrastructure at ports, safety regulations and logistical considerations are already well understood and in use. The favourable properties discussed have resulted in green ammonia being one of the primary fuel candidates for the future maritime zero carbon fuel in addition too green methanol (e-methanol and biomethanol) and alcohol-lignin blends.

NexantECA - Fuel Volumetric Energy Density

There are still several challenges that will need to be overcome before ammonia can be deployed an industry wide bunker fuel.

Ammonia does not sustain combustion except for under a narrow fuel to air mixture of 15 – 25 percent air. This makes complete combustion rarely achievable resulting in the production of nitrous oxide (NOx) emissions. NOx are a key contributor to global climate warming and have a global warming potential 250-300 times larger than CO2 across a 100-year timescale. Post combustion scrubbing, adsorption or NOx suppression will need to be implemented to exhaust emissions.

Existing industrial shipping engines and on-board storage tanks are not compatible with ammonia due to the high ignition energy required to combust ammonia, relatively narrow fuel to air ratio required and complexities introduced by the safety concerns related ammonia. Ammonia specific technology will require development and commercialisation.

Green Ammonia has not yet been accepted as a maritime fuel under the IMO’s IFG code (The International Code of Safety for Ships using Gases or other Low-flashpoint Fuels). However, there are decades of experience with ammonia as a cargo in the industry and despite being subject to tighter scrutiny as fuel is not expected to pose as a barrier to entry to the market.

Even though ammonia has an established market and infrastructure, additional demand from new uses such as marine fuels and power generation might require huge investments in new infrastructure, which in the short term might slow down market penetration.

Green ammonia production is still significantly more expensive than the fossil fuel alternative to produce. In the long term green ammonia production will be required to meet IMO 2050 Net Zero targets however in the short to medium governmental support, in the form of CO2 tax for example, will be required to make green ammonia an economically viable options for industrial shipping companies.

NexantECA expect the technical challenges associated with the use of Ammonia as a marine to overcome in the next decade and it is expected that ammonia and other net zero carbon fuels will be demonstrated at an industrial scale in 2024/2025 and then start entering commercial fleets by 2030. Whilst various zero carbon fuels are in development it is difficult to predict which technology will be the most successful, but it would appear that a mixture will be employed to meet the IMO’s a target of reduction in carbon intensity (CO2 per tonne-mile) by at least 40 percent by 2030 and reduction in GHG emissions by 50 percent in 2050 compared 2008 levels.

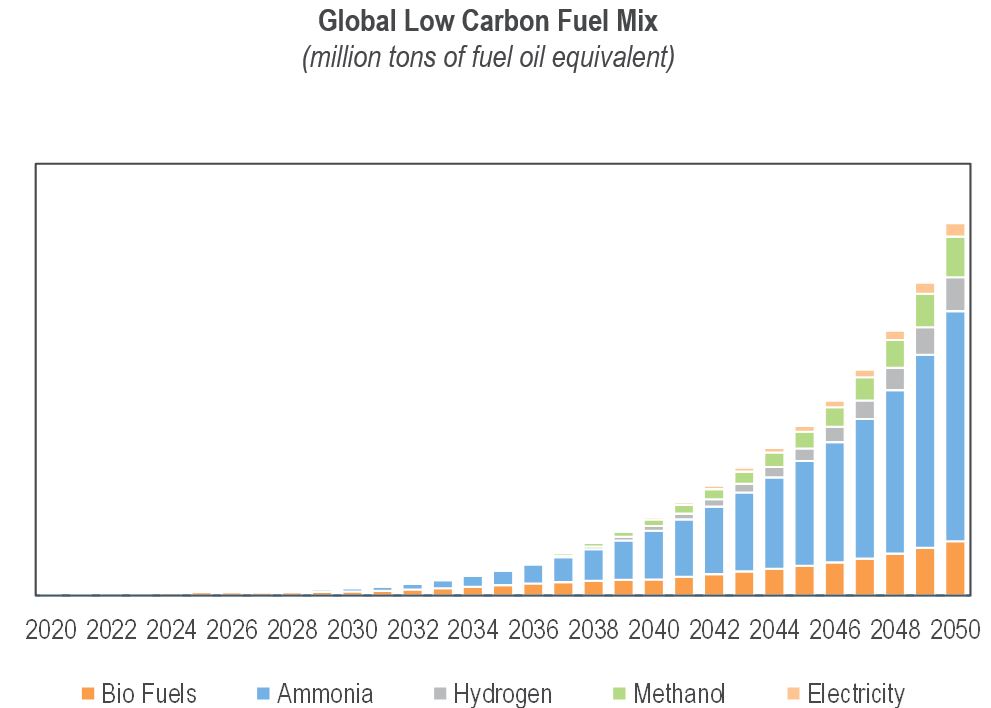

A scenario where Ammonia accounts for 60 percent of the low carbon marine fuel mix by energy has been displayed in the figure below. In this scenario the demand for blue/green ammonia as a marine fuel will have reached over 13 million tons by 2040, increasing to almost 64 million tons by 2050 as efforts excellent to reach industry wide 2050 decarbonisation targets.

NexantECA - Global Low Carbon Fuel Mix

Significant investment will be required in both the supply chain infrastructure and global capacity to meet the forecast demand for blue/green Ammonia. This will include addition of large scale ammonia storage and marine loading facilities at bunker locations globally and the production of Ammonia fuelled ships. NexantECA would expect green ammonia production technology to be well understood and mature enough to accommodate the significant rise in green Ammonia from 2040 onwards if the capital required for investment and spare global renewable energy capacity is available.

NexantECA - Global Ammonia Capacity Development

Find out more...

Market Insights: Ammonia - 2021 investigates global ammonia markets from 2015, with outlook to 2045, including the following content:

Discussion on key market driver and constraints including regulatory, environmental, consumer and technology trends, and future uses as a carbon free energy carrier, marine fuel and current barriers to market (scale, technology readiness, NOx emissions).

Demand by end use by region/country (North America, South America, Western Europe, Central Europe, Russia, Other Eastern Europe, Middle East, Africa, China, India, Other Asia Pacific), including discussions on drivers and constraints shaped by regulatory and consumer trends

List of capacities worldwide

Pricing analysis and forecast

Regional cost competitiveness covering cash cost of production for brown, blue and green ammonia.

Summary (Porter 5 Force Analysis)

The Author

Jack Walters, Senior Analyst