Petrochemicals and polymers: Quarter four performance

Weakening global markets blight cost competitiveness of naphtha crackers despite steady downturn in oil prices as supply side risk in energy markets abates in second half of 2022

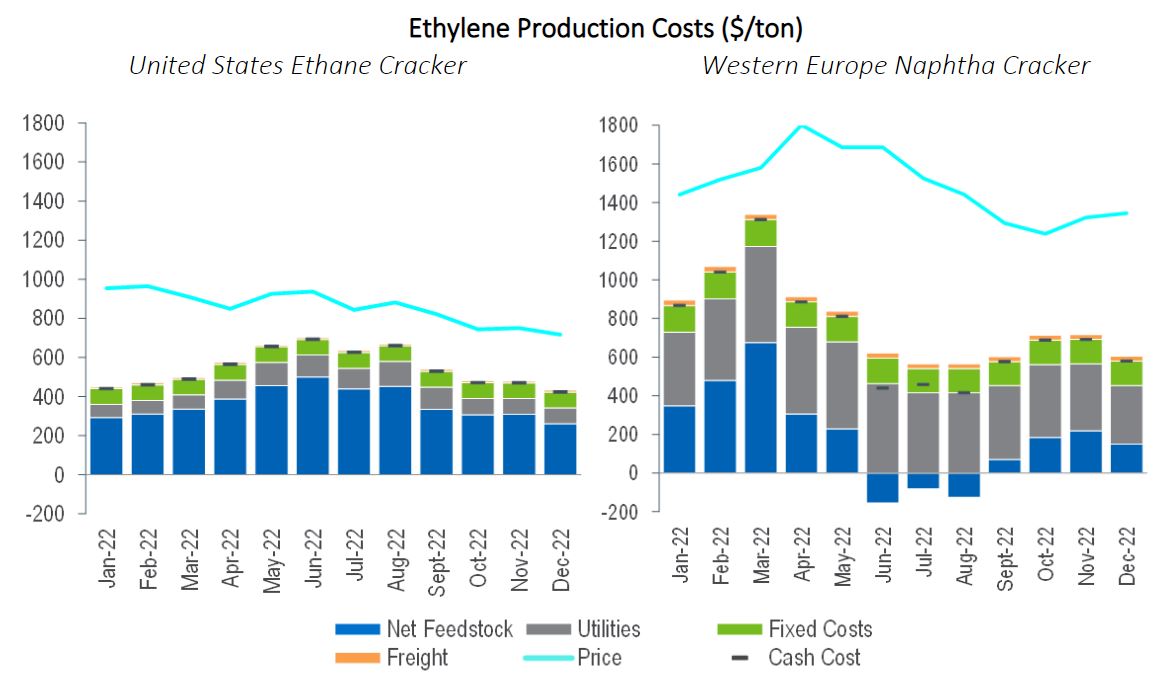

Feedstock selection has long been a fundamental driver of competitiveness in the global petrochemical industry, with access to alternative feedstocks enabling a very different cost base. A turbulent operating environment confronting the global petrochemical industry through 2022 prompted rapid divergence of production costs transformed competitiveness of much of the industry supply base with limited flexibility in feedstock processed. Volatile global energy markets led feedstock costs to deviate, locking in the largest tranche of petrochemical production costs. Rapidly shifting dynamics of co-product markets further clouded competitiveness of ethylene heading the cost base of the industry. Processing heavier feedstocks offers opportunity to earn considerable co-product revenue and offset the cost of acquiring feedstock defined in upstream energy markets.

Supply side risk in global energy markets was the dominant influence in the first half of the year as a widening boycott of Russian energy streams shocked markets. Feedstock costs escalated as global energy markets were pinched tight against steady demand growth. Gas offered a cost advantage early in the year as naphtha prices followed crude oil to a ten year high, approaching $1000 per ton in March. Global gas prices lagged the upturn in oil prices but the upturn swiftly accelerated towards the middle of the year. Disruption of gas pipelines deliveries from Russia into Europe pinched global gas markets tight as incremental demand for scarce prompt LNG cargoes surged. Lengthy supply capped naphtha costs as subdued demand in petrochemical markets diverged from resilient seasonal demand for gasoline. Fears of supply disruption following the deepening conflict in Ukraine elevated revenue earned in co-product markets and naphtha cracker costs retreated rapidly into the second half of the year.

Global gas costs relaxed into the closing quarter of the year as sufficient inventories were elevated above seasonal expectations. A hastening downturn in global economic activity eased demand side pressures in energy and chemicals markets. Weakening petrochemical markets heavily depressed co-product revenue earned on cracking heavier feedstocks. Naphtha prices lagged the steady downturn in crude oil prices as resilient gasoline blending values defined a floor to naphtha cleared in petrochemical markets. Little cost benefit was realised on cracking naphtha as the cost of processing gas relaxed from the peak faced towards the middle of the year.

Petrochemicals and Polymers: Quarter four performance

The recently published NexantECA Quarterly business analysis report addresses trends in cost, price, and margin in a turbulent operating environment.

Persistently weak Asian markets remain plagued by excess capacity with prompt demand showing little response to changing attitude to COVID-19 management in China

Asian petrochemical markets remained soft, with demand across most value chains hindered by Chronic oversupply, a pessimistic economic outlook, and currency weakness. Expectation of easing of the COVID19 restrictions in China had limited impact on demand. Supplies in Asia remained persistently lengthy as the abrupt downturn in demand failed to adsorb the latest phase of new capacity coming onstream. Competition from import cargoes deepened as freight rates relaxed and the hastening downturn in global markets saw surplus material seeking the leading demand centre in China. Lengthy markets routinely confined profitability towards the lower end of its historic range, despite steady easing of upstream costs.

European industry suffered greatest downturn in profitability for seven years as deteriorating economic climate stalled demand and stagnant naphtha cracker costs tested competitiveness.

Petrochemical markets in Western Europe were burdened with fragile demand as inventories backed up supply chains. Consumer confidence in the economic climate remained thin as Euro zone GDP grew at its slowest rate since normalising from disturbance of the COVID19 pandemic and Euro zone inflation escalated above ten percent. Manufacturing industry activity slowed and some production lines planned extended seasonal shutdowns as warehouses filled. Demand was confined to contract commitments, with little appetite for spot business. Lack of cost competitiveness curtailed export opportunities despite the Euro weakening to a twenty low approaching parity against the Dollar. Supply was ample to cover persistently weak demand, prompting widespread reduction to operating rates despite extensive disruption to production through scheduled maintenance and industrial disputes.

Easing crude oil prices offered little relief to production costs as weak co-product markets and inertia in naphtha prices compromised competitiveness of naphtha crackers. The NexantECA petrochemical profitability index tumbled 45 percent from historic highs achieved through the middle of the year. Profitability returned close to the average achieved in more stable markets through the decade to 2020 ahead of upside delivered by supply disruption post COVID-19 and the more recent conflict in Ukraine.

Petrochemical profitability in U.S. remained thin as deepening competition to clear surplus supply in export markets depressed prices and gas price inertia limited realisation of cost savings as energy values eased

The petrochemical market in the United States was burdened with weak domestic demand and consistently lengthy supply in the closing quarter of 2022. A seasonal decline in demand was exacerbated by economic weakness and recession concerns which restricted discretionary consumer spending on durable goods. Diminishing activity in construction and housing sectors further curtailed offtake of petrochemicals. Deepening competition in export markets compounded pressure on volumes as export cargoes were increasingly difficult to place in previously favoured markets.

Feedstock costs moderated as gas prices relaxed from 14 year high in Q3. Ethane prices remain at upper end of range explored over last decade, easing 20 percent since the conflict in Ukraine shocked energy markets in March. Cost savings were swiftly surrendered as petrochemical prices dropped alongside steeper falls in naphtha and crude oil that determine cost base and price point elsewhere. Renewed competition in lengthy global markets realigned U.S. prices with those in Asia as lengthy Asian markets exported surplus. The price premium in Europe offered few opportunities as heavy discounts in spot markets failed to stimulate demand beyond contract commitments. Industry profitability decreased for fifth straight quarter returning towards floor found as the COVID-19 pandemic disrupted markets in 2020.

Broadening weakness across global export markets plunged profitability of export business from Middel East to historic lows in a comparable cost environment.

Profitability of export business from the Middle East fell to a twenty year low excluding the shock of the COVID-19 pandemic in the first half of 2020. Hastening downturn in the global economic climate curtailed demand across principal export markets and high inventories limited appetite for purchasing spot cargoes. The cost advantage of feedstocks offered at a steady price under long term supply contracts narrowed as oil prices dropped 30 percent through the second half of the year, reversing gains built in the first half of the year. Average industry profitability has tumbled 50 percent since the concentrated recovery from the COVID-19 pandemic pinched markets tight in the first half of 2021.

Find out more...

Quarterly Business Analysis: Middle East - Q4

The Quarterly Business Analysis provides key insight into production economics for a broad range of commodity petrochemicals, polymers and C1 chemicals. The analysis presents a review of costs, prices and margins for typical production assets, providing a valuable view of regional and value chain competitiveness and is is available for each key price setting region - Asia Pacific, Middle East, Western Europe and the United States. A quarterly report provides insightful commentary to illustrate current trends, related to recent market developments. The accompanying database is updated monthly.