Carbon Dioxide - A global and regional market outlook

Carbon is one of the natural occurring elements the make up everything that the world is made from. It is in the air, the soil, the rocks, the oceans, and all living things including humans. There is a fixed amount of carbon on earth, and it is reused repeatedly, represented by the carbon cycle.

Carbon dioxide (CO2) is a colourless gas, normally odourless but in high concentration can have a sharp smell. As a greenhouse gas (GHG), it is released into the atmosphere and into the oceans naturally as part of the Earth's carbon cycle by a range of mechanisms, including plant and animal respiration, organic matter decay, and volcanic activity. The gas is also emitted through human activities. Humans collectively behave like a giant volcano generating more than 100 times the carbon emissions from the active volcanoes combined, disrupting the carbon cycle largely by use of fossil fuels that are created by plants and animal remains crushed underground for millions of years

Global CO₂ emissions in 2022 are estimated at 36.8 billion tons, according to the International Energy Agency (IEA). Nearly 40 percent is coming from power generation. Industry produces over 9 billion tons of direct CO₂ emissions in 2022 including the cement, iron and steel, chemicals, and other sectors.

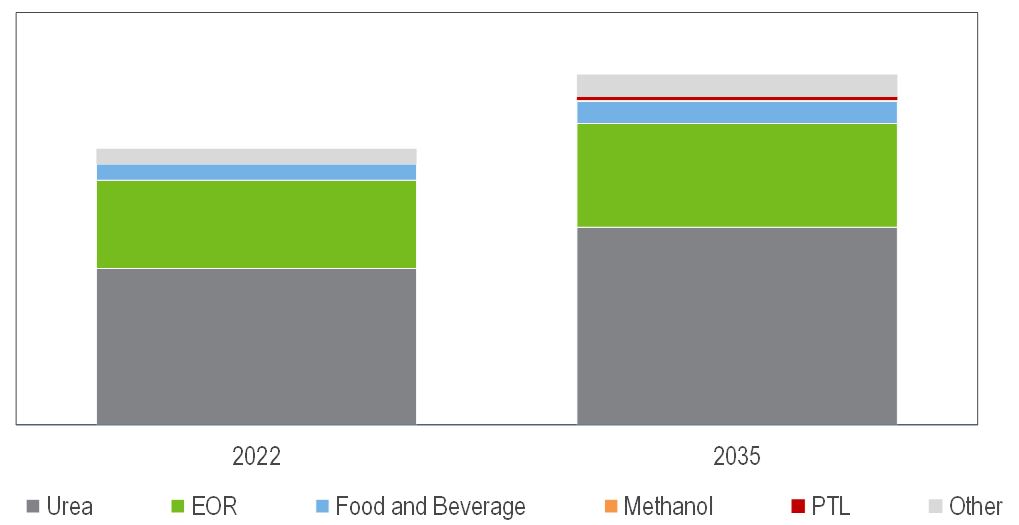

CO₂ Demand

The global CO₂ demand has a modest impact on GHG emissions reduction, especially as majority of current consumption releases CO2 back into the atmosphere such as urea, enhanced oil recovery (EOR) and food and beverage. However, development in utilizing CO2 cannot be underestimated, particularly in chemical synthesis. Much progress has already been made in recent years in the research and development (R&D) for processes that could produce chemicals and polymers from CO2, particularly in the production of methanol, fuels via Power-to-Liquids (PTL) and carbonates including polyols, polycarbonates, and concrete manufacture etc.

Global CO2 Demand

Global CO2 Demand

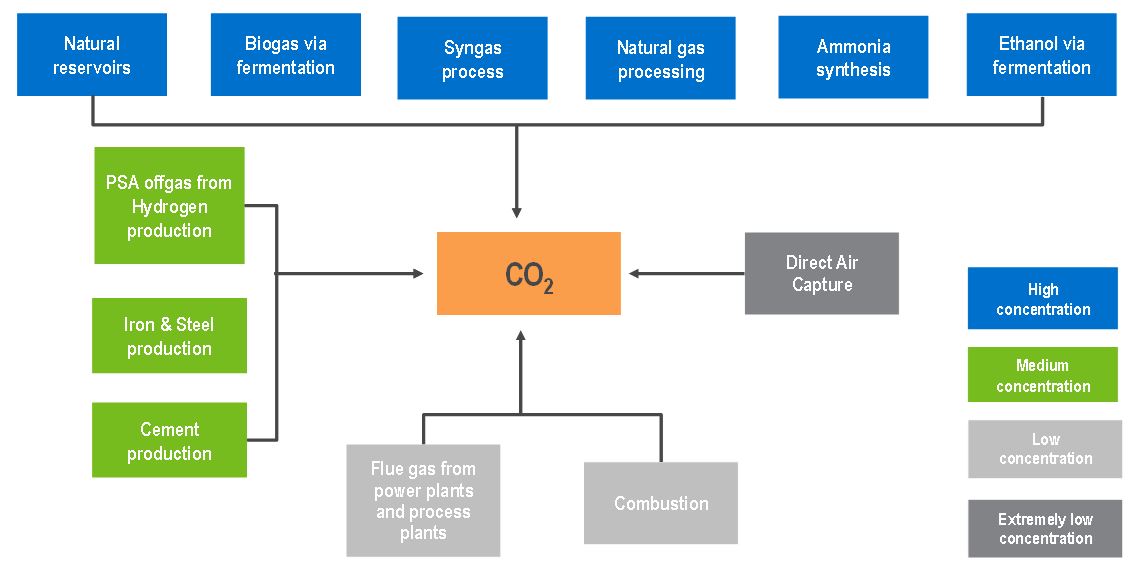

CO₂ Supply

Commercial supply is led by sources where CO2 has a high concentration that provides a cost advantage in both operational and capital terms. Although technical solutions for the avoidance, removal, or redirection of CO2 streams have long existed, the major obstacle has been the economic viability based on the concentration of the emission sources. Global CO2 supply varies from region to region which depends on availability of high concentration CO2, from natural resources and/or industrial activities. The largest supply of commercially traded CO2 is in fact from a natural CO2 field, the McElmo Dome in Colorado, that contains close to 2 billion tons of high purity CO2. Another notable example is the Jackson Dome in Mississippi that holds around 250 million tons of high purity CO2. There are numerous natural CO2 fields within sedimentary basin globally. Some have held CO2 for millions of years without leakage, but many others do leak. Leakage generally manifests itself as carbonated springs or dry seeps.

Sources of CO₂ Supply

Sources of CO₂ Supply

Carbon Pricing and Utilization Cost

Carbon pricing is a policy instrument that charges those who emit CO2 for their emissions, either in the form of a carbon tax or within ETS (Emissions Trading Scheme). Carbon pricing can act as an incentive to capture CO2 and use it (or sell it for use) in the manufacture of products or services, provided this is the cheapest compliance strategy for the emitter. However, the cost of using CO2 as a feedstock for products or services is often too high relative to other compliance strategies such as CO2 storage or simply paying the carbon price, and purified CO2 is required to be used as a feedstock. However, as CO2 conversion costs are expected to decline over time while carbon prices increase, there may be instances in which CO2 use becomes a cost-effective strategy.

Global ETS and carbon taxes have weathered the 2022 global energy crisis relatively well. Carbon prices increased in half of ETS or carbon taxes, although in real terms surging inflation will have offset some of the increases. The most notable increases are EU ETSs. There were only a few instances where governments wound back ETS or carbon taxes in response to the energy crisis by delaying the start of a new instrument, postponing a planned expansion or price increase, or in one case repealing a carbon tax. With several new instruments launched and some scope expansions, the number of implemented instruments increased to 73 with the share of global GHG emissions covered around 23 percent.

Find out more…

Market Insights: Carbon Dioxide - 2023 is one in a series of reports published as part of NexantECA’s Markets & Profitability program. This NexantECA’s Market Insights report provides a comprehensive review of the global carbon dioxide market, including sources of CO2 supply and demand in urea, enhanced oil recovery (EOR), food and beverages, methanol, Power-to-Liquids (PTL) and others including carbonates etc. The following scope is covered:

Regulatory framework and development in major countries

CO2 Capture and Sequestration (CCS)

CO2 Utilization

Market Outlook for nine regions: North America, South America, Western Europe, Central Europe, Eastern Europe, Middle East, Africa, China and Other Asia Pacific

Carbon pricing discussions

Competitiveness analysis of CO2 derived chemicals including methanol and polycarbonate

Forecast period: history to 2015 and forecast to 2035

Along with the written report, data is provided in Excel including market and competitiveness data. To view the Table of Contents and Flyer, please visit Market Insights: Carbon Dioxide - 2023

Market Insights are a series of commercial reports focusing on extended energy and chemicals value chain, where you will be able to “look under the skin” and discover market drivers and competition in depth

The Authors...

Xuesong Peng, Market Insights Manager

Pat Sonti, Senior Consultant