Global Green Methanol Market Snapshot

Green methanol technologies are being developed on a large scale in order to meet upcoming net-zero targets, mainly in the fuels sector. Compared to traditional methanol and fuels such as HSFO and gasoline, green methanol provides reduced carbon intensities and meets other targets such as those for desulphurization of marine fuels.

Currently 122 million tons of methanol are produced globally per year via combined reforming, steam reforming of natural gas and coal gasification methods. The end uses of methanol largely fall under fuel applications or chemical synthesis. Methanol is currently directly blended into gasoline as well as being used to synthesize fuel additives such as MTBE and DME. It is also consumed in the production of biodiesel and has been identified as a potential low-sulphur marine fuel alternative. Chemical end uses include formaldehyde, acetic acid and olefins.

e-methanol is produced by combining green hydrogen, produced from renewable electricity, and captured CO2 produced either from direct air capture (DAC) or captured from flue gas. Currently it is only performed on small scales due to the instability of renewable energy rates and prices.

bio-methanol is produced from sustainable biomass sources such as agricultural waste and MSW or from biogas from a variety of sources including livestock wastes. When bio- derived CO2 is utilized alongside H2 generated from renewable electricity to synthesize methanol, the product is known as e-bio-methanol. e-biomethanol has further reduced carbon intensity (CI) compared to other green methanol technologies. Thus far, bio-methanol has been produced on the 300 thousand tons per year scale, with offtake agreements for future projects in place with shipping companies such as Maersk.

Although e- and bio-methanol are not currently cost competitive they do have reduced carbon intensity compared to traditional methanol and other fuels such as gasoline and HSFO. Within the EU, the Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism ( CBAM) are encouraging the adoption of green alternatives, particularly in fuel applications. Elsewhere, there are smaller scale ETS projects in some US states, Mexico, and regions in China which may target methanol facilities in the future. Additionally, the US, China and Brazil have fuel targets which encourage methanol blending or the use of methanol derived additives. The IMO has introduced a net-zero by 2050 mandate on shipping fuels worldwide which promotes green methanol as an alternative.

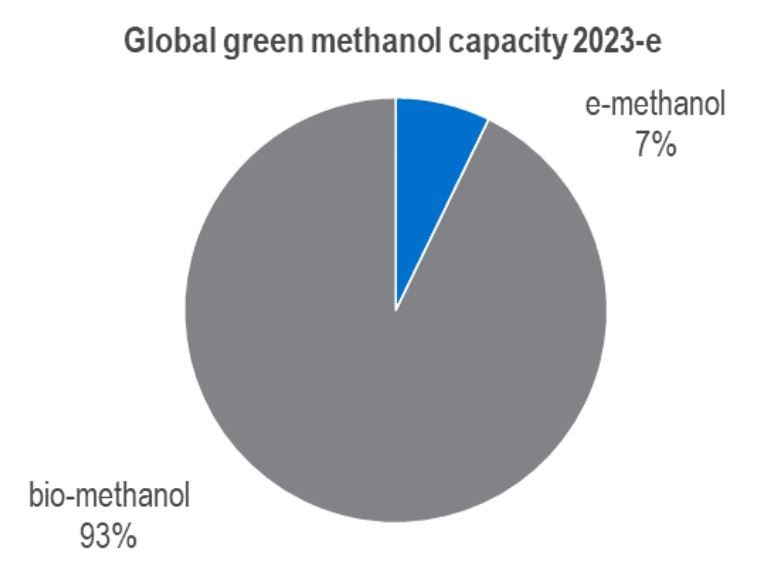

Total global green methanol capacity is estimated at 536 thousand tons in 2023, an increase from 390 thousand tons in 2022. The five largest producers currently make up 85 percent of global capacity for green methanol, all utilizing bio-methanol based technology. The scale of e-methanol is relatively small and scale up is linked to the size of electrolysers, which require reliable renewable electricity supply and pricing to become competitive. Bio-methanol capacity growth is more likely in the near term, as it is more established as a technology and can use a range of feedstocks.

Global Green capacity 2023 - NexantECA

Green methanol adoption is largely reliant on policy, and is therefore currently concentrated in Western Europe, with some adoption in North America. Large expansion is expected in China, as they aim to reduce their reliance on coal feedstocks. By 2030, global demand is expected to reach 4.3 million tons per year.

Find out more...

Market Scenario Planning: Green Methanol - 2023

This report provides NexantECA’s scenario forecast for biomethanol and e-methanol demand to 2050 by key region and application (marine fuel, other fuel and chemical derivative). Scenarios forecast demand based on low, base and high assumptions whereby underlying policy, cost learning curves and adoption of e-methanol evolve in fundamentally different ways. As well as the scenarios, detail on the current situation of the market and key market drivers are provided.

This report is part of our new Market Scenario Planning program which looks at emerging products, market events and end-use industries where scenario forecasting provides more value due to the higher uncertainty associated with the subject. Scenarios are defined as low, base and high and are informed by NexantECA’s expert knowledge of petrochemical markets.

The Author...

Charlotte Borrill, Analyst