New TECH Report - Crude Oil-to-Chemicals (2025 Program)

Crude Oil-to-Chemicals is one in a series of reports published as part of NexantECA’s 2025 Technoeconomics – Energy & Chemicals (TECH) program

Overview

Regulations, fuel efficiency improvements and decarbonization of the transportation sector have reduced demand for liquid fuels that have been conventionally produced from the distillation of crude oil followed by further processing in refineries. While demand for liquid fuels has declined, demand for petrochemicals such as ethylene, propylene, benzene, toluene and xylenes continues to expand with economic growth.

Petrochemicals production has long been associated with processing refinery-based streams such as gas oil, naphtha, and LPG. In the absence of suitable alternative feedstocks, the production of petrochemicals will continue to rely on fossil-based crude oil streams, thus refineries are shifting their emphasis from fuels (gasoline, diesel, and jet) production to petrochemicals production by integrating the required processing units to produce higher levels of petrochemical feedstocks. Integrated refinery and petrochemical plants now have production capacities that are two to six times the capacities of world scale petrochemical plants and are capable of producing up to nine million tons of petrochemical products per year. These integrated refinery and petrochemical plants are known generally as crude oil-to-chemicals (COTC) plants.

Achieving high petrochemical yields and capacities is complex and involves the management and processing of different fractions of hydrocarbon streams obtained from the distillation of crude oil. The quality of the crude oil processed (high or low density, high or low sulfur, etc.) as well as the desired fuels products, if any, impacts refinery process design. Further consideration of the desired petrochemicals product slate and required petrochemical feedstocks is also necessary. These all impact the process design of the COTC plant.

This TECH report discusses the various contemporary and hypothetical configurations for COTC plants and respective developing technologies and addresses the following questions:

What process technologies are required for COTC plants?

How is a COTC plant configured for aromatics and/or olefins production?

What are the process challenges for various COTC configurations?

How does chemicals yield change for different COTC configurations?

How does crude oil quality impact chemicals yield and process configuration?

What current developments are underway to improve the yield of chemicals from crude oil?

How competitive are COTC configurations compared to a conventional refinery?

Technologies & Configurations Overview

Commercial and developing process units for COTC complexes by Axens, Chevron Lummus Global, Eni, Honeywell UOP, KBR, Sinopec and others are included in the report. Various COTC configurations for different product slates, emphasizing aromatics and olefins production, are also included.

Process Economics

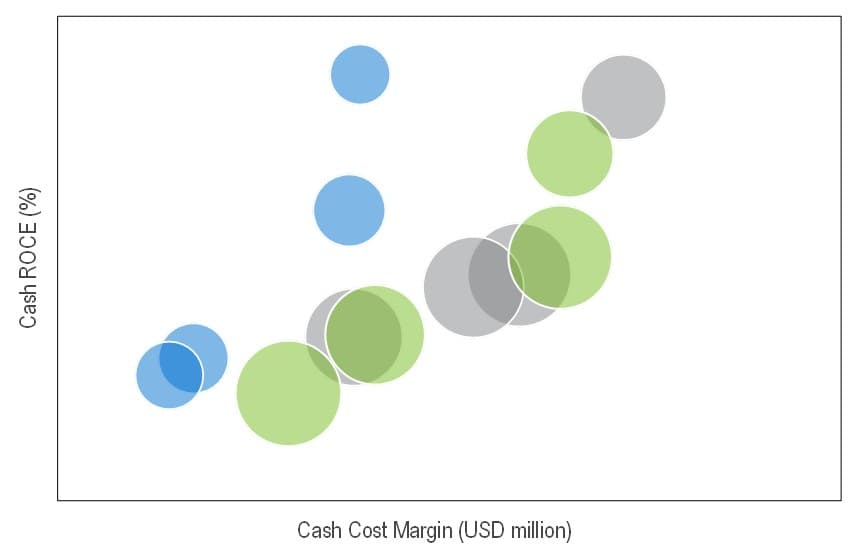

Process economics for various configurations of COTC plants are presented for the Middle East, China, South Korea and Southeast Asia.

Example of Process Economic Analysis for Various COTC Configurations in Different Regions